Real estate is often seen as a reliable way to grow wealth, but many people hesitate to invest due to the high costs of purchasing property. The good news is that it’s entirely possible to tap into the real estate market without needing to buy a home, condo, or commercial building. Whether you’re looking to diversify your investment portfolio or simply enter the market with less upfront capital, there are multiple options available.

1. Real Estate Investment Trusts (REITs)

A simple and accessible way to invest in real estate—without actually purchasing property—is by investing in Real Estate Investment Trusts, or REITs. These companies specialize in owning, operating, or financing properties that generate income, such as office towers, apartment buildings, and retail centers.

By purchasing shares in a REIT, you’re gaining exposure to a portfolio of real estate assets managed by professionals. Investors typically earn returns through dividend payouts and the potential for long-term appreciation of the underlying properties.

There are three main types of REITs to consider:

1. Equity REITs

These own and operate income-producing properties. They make money primarily through rent and can also profit from selling properties that have appreciated in value.

2. Mortgage REITs (mREITs)

These invest in mortgages or mortgage-backed securities. Their income comes from the interest on these real estate loans.

3. Hybrid REITs

These REITs blend the approaches of both equity and mortgage types, simultaneously investing in physical properties and mortgage-backed assets.

REITs remain a go-to option for passive income seekers, largely because they must, by law, pay out at least 90% of their taxable earnings to shareholders in the form of dividends—a feature that strongly appeals to income-oriented investors. That being said, it’s worth remembering that these dividend payouts are usually taxed as regular income rather than benefiting from the lower capital gains tax rate.

2. Real Estate Mutual Funds

Real estate mutual funds let investors tap into the real estate market without the need to purchase or manage properties directly. By pooling capital from many individuals, these funds invest in a mix of real estate-related assets, such as REITs, real estate operating companies, and other property-linked securities. One key advantage is built-in diversification: the fund typically spreads investments across various real estate sectors, including residential, commercial, and industrial.

Although these funds are overseen by professional managers, they often come with higher fees than REIT ETFs or standalone REIT investments. Still, for those looking for streamlined access to real estate exposure without juggling multiple holdings, real estate mutual funds offer a convenient, hands-off solution.

3. Real Estate Exchange-Traded Funds (ETFs)

For those looking for an easy, low-cost way to invest in real estate, real estate exchange-traded funds (ETFs) may be the right choice. These funds track the performance of real estate-focused indexes, often through equity REITs and other real estate-related securities. Unlike mutual funds, real estate ETFs are typically passively managed, meaning they seek to replicate the performance of a specific index rather than actively selecting investments.

Investing in a real estate ETF provides broad exposure to the real estate market, making it a good option for those who want to diversify with just one investment. Most ETFs also have lower expense ratios than actively managed funds, making them a more cost-effective option for investors.

4. Real Estate Crowdfunding

Real estate crowdfunding offers a modern, accessible route into property investing—no direct ownership required. Through this model, individuals pool their funds to back real estate ventures, ranging from residential builds to large-scale commercial projects. Most crowdfunding platforms let users invest modest amounts in specific deals, lowering the barrier to entry for those without deep pockets.

What draws many to this approach is the chance to be part of real estate opportunities that might typically be reserved for institutional investors or high-net-worth individuals. Returns may come from both rental income and property value growth. That said, it’s not without its pitfalls—crowdfunded projects can underdeliver or even fail, so there’s always a level of risk involved.

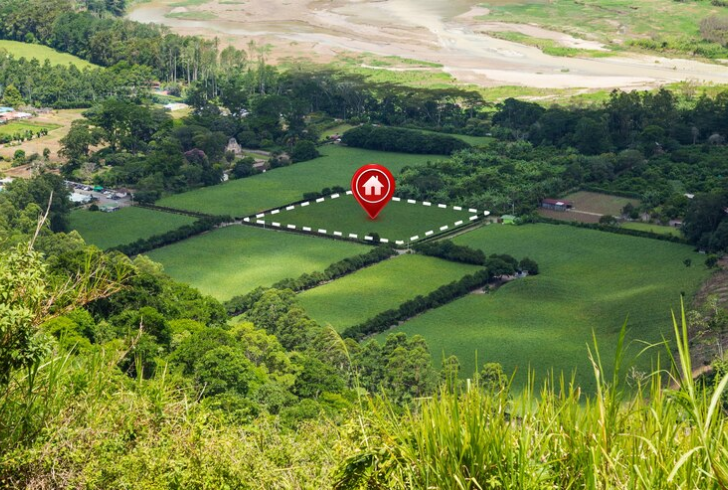

5. Purchasing Land

While it’s not the same as buying a home or commercial property, purchasing raw land is a viable way to invest in real estate. Land tends to have lower upfront costs and minimal maintenance expenses, as it doesn’t require utilities, upkeep, or the same kind of management as developed properties.

While the returns on land investments can take time to materialize, particularly if you’re holding the land for long-term appreciation, it can be an effective way to get into real estate. Land is often subject to lower property taxes, making it an affordable option for those looking to invest without the burdens of property management.

6. Real Estate Notes

Investing in real estate notes offers a way to earn income from real estate without owning physical property. A real estate note is essentially a debt instrument, where you buy a mortgage or a loan that a borrower is repaying. When you purchase a note, you step into the shoes of the lender, collecting payments (with interest) from the borrower over time.

This type of investment can be more hands-off than other real estate options, as you don’t have to deal with tenants or property maintenance. However, there are risks involved, such as the borrower defaulting on the loan. This typically requires a larger upfront investment than options like REITs or crowdfunding, but it can be an appealing choice for those looking for consistent returns over time.